| Accountancy NCERT Notes, Solutions and Extra Q & A (Class 11th & 12th) | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 11th | 12th | ||||||||||||||||||

Chapter 4 Recording Of Transactions-II Concepts, Solutions and Extra Q & A

This chapter introduces Special Purpose Books, also known as Subsidiary Books, as a practical solution to the limitations of a single journal in a growing business. As the volume of transactions increases, recording every entry in one journal becomes inefficient. To streamline this process, repetitive transactions are classified and recorded in dedicated day books.

The primary subsidiary books include the Purchases Book for credit purchases of goods, the Sales Book for credit sales of goods, and their respective return books. The most significant among these is the Cash Book, which uniquely functions as both a journal and a ledger for all cash and bank transactions. It can be a single, double, or triple column book, and includes a specialized version called the Petty Cash Book for managing small, routine expenses under an imprest system.

Any transaction that does not fit into these specialized books, such as the credit purchase of an asset or rectification entries, is recorded in the Journal Proper. This systematic division makes accounting faster, more accurate, and allows for an efficient division of labor.

Need for Special Purpose Books

In a small business with a limited number of transactions, it might be feasible to record all business activities chronologically in a single book of original entry—the Journal. However, as a business expands, the volume and frequency of transactions increase dramatically, making the use of a single journal highly impractical and inefficient. This leads to several significant problems.

Limitations of Using a Single Journal

Relying solely on one general journal for all transactions in a large business creates several operational bottlenecks:

-

Voluminous and Bulky Records: A single journal becomes excessively large and unwieldy, making it difficult to handle, store, and reference. Locating a specific transaction from months ago can be a tedious task of sifting through hundreds of pages.

-

Repetitive and Monotonous Work: Many business transactions are highly repetitive, such as cash sales, credit purchases, etc. Journalizing each of these individually involves writing the same account names (e.g., "Cash A/c Dr.", "To Sales A/c") over and over, which is a monotonous process and increases the likelihood of clerical errors.

-

Information is Not Readily Available: The journal records information chronologically, not analytically. If management wants to know the total credit sales for a week, an accountant would have to manually scan the entire journal for that period and add up each individual sales entry. This is time-consuming and delays decision-making.

-

Impossibility of Division of Labor: With only one journal, only one accountant can record entries at a time. This creates a significant bottleneck. It is not possible to divide the work of recording transactions among several clerks to keep the accounting records up-to-date.

To overcome these limitations, the journal is sub-divided into several specialized journals. Each special journal is designed to record a specific type of frequent and repetitive transaction. These books are collectively known as Special Journals, Day Books, or Subsidiary Books.

Types of Special Purpose Books and Their Functions

The sub-division of the journal results in the following primary subsidiary books, each with a distinct purpose:

-

Cash Book: This is arguably the most important subsidiary book. It is used to record all transactions involving cash and bank, including all receipts and payments. It functions as both a journal and a ledger.

-

Purchases Book (or Purchases Journal): This book is used to record only the credit purchases of goods. 'Goods' refers to the items in which the business deals (i.e., items bought for the purpose of resale).

Note: Cash purchases are recorded in the Cash Book, and credit purchases of assets (like furniture or machinery) are recorded in the Journal Proper. -

Sales Book (or Sales Journal): This book is used to record only the credit sales of goods.

Note: Cash sales are recorded in the Cash Book, and credit sales of assets are recorded in the Journal Proper. -

Purchases Return Book (or Return Outwards Journal): This book is used to record goods that are returned to suppliers, which were originally purchased on credit.

-

Sales Return Book (or Return Inwards Journal): This book is used to record goods returned by customers, which were originally sold to them on credit.

-

Journal Proper (or General Journal): This is the residual journal. It is used to record transactions that cannot be entered in any of the other specialized subsidiary books. This includes entries such as opening entries, closing entries, adjustment entries (e.g., depreciation), rectification entries, and the credit purchase or sale of assets.

Using special journals is economical, saves time, and facilitates the division of accounting work, leading to greater efficiency, accuracy, and better internal control.

The Cash Book

The Cash Book is a special journal designed exclusively to record all transactions involving cash and bank. Given that cash is the most liquid asset and the most frequent type of transaction for any business, it requires meticulous tracking. The Cash Book is one of the most vital and universally maintained subsidiary books in any organization, from a small local shop to a large multinational corporation.

The Dual Nature of the Cash Book

The Cash Book holds a unique and powerful position in the accounting system because it serves a dual purpose, functioning simultaneously as a journal and a ledger. This characteristic makes it exceptionally efficient.

Book of Original Entry (A Special Journal)

Like other subsidiary books, the Cash Book is a book of primary entry. All cash and bank transactions are recorded here for the first time, directly from source documents like cash memos, receipts, vouchers, pay-in-slips, and cheque counterfoils. The entries are made in chronological order (date-wise), which is the fundamental characteristic of a journal. By recording all cash transactions here, they are kept out of the general journal, which prevents the journal from becoming excessively bulky and saves significant time and effort.

Book of Final Entry (A Principal Book/Ledger)

The format of the Cash Book is identical to that of a ledger account. It has a 'T' shape with a distinct debit side (for receipts) and a credit side (for payments). It effectively acts as a complete, self-contained ledger account for cash. In the case of a double or triple column cash book, it also serves as the ledger account for the bank and discounts.

Because the Cash Book itself functions as the ledger account for cash (and bank), a crucial rule emerges: when a Cash Book is maintained, no separate 'Cash Account' or 'Bank Account' is opened in the general ledger. The Cash Book itself provides the final balances for these items. The closing balance of the Cash Book is directly taken to the Trial Balance and subsequently to the Balance Sheet. This integration of recording and summarizing is what makes the Cash Book a principal book of accounts.

Because of this unique dual role, it is correctly said that the Cash Book is both a journal and a ledger. It is a book where transactions are first recorded (journalizing) and are also simultaneously posted (to the cash/bank account), making it a "journalized ledger."

Single Column Cash Book

The Single Column Cash Book is the simplest form of cash book. It is used when a business carries out all its transactions exclusively in cash. It has one amount column on each side—the debit side for recording cash receipts and the credit side for recording cash payments.

Format of a Single Column Cash Book

The format resembles a standard T-account, with columns for date, particulars, and amount on both sides.

Cash Book

Dr. (Receipts) Cr. (Payments)

| Date | Particulars | L.F. | Amount (₹) | Date | Particulars | L.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

Example. Prepare a Single Column Cash Book for M/s Roopa Traders from the following transactions for November 2017.

- Nov. 01: Cash in hand ₹ 30,000

- Nov. 04: Cash received from Gurmeet ₹ 12,000

- Nov. 08: Insurance paid ₹ 6,000

- Nov. 13: Purchased furniture ₹ 13,800

- Nov. 16: Sold goods for cash ₹ 28,000

- Nov. 17: Purchased goods in cash ₹ 17,400

- Nov. 20: Purchased stationery ₹ 1,100

- Nov. 24: Cash paid to Rukmani ₹ 12,500

- Nov. 27: Sold goods for cash ₹ 18,200

- Nov. 30: Paid monthly rent ₹ 2,500

- Nov. 30: Paid salary ₹ 3,500

- Nov. 30: Deposited in bank ₹ 8,000

Answer:

M/s Roopa Traders

Cash Book

Dr. (Receipts) Cr. (Payments)

| Date | Particulars | L.F. | Amount (₹) | Date | Particulars | L.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Nov. 01 | To Balance b/d | 30,000 | Nov. 08 | By Insurance A/c | 6,000 | ||

| Nov. 04 | To Gurmeet's A/c | 12,000 | Nov. 13 | By Furniture A/c | 13,800 | ||

| Nov. 16 | To Sales A/c | 28,000 | Nov. 17 | By Purchases A/c | 17,400 | ||

| Nov. 27 | To Sales A/c | 18,200 | Nov. 20 | By Stationery A/c | 1,100 | ||

| Nov. 24 | By Rukmani's A/c | 12,500 | |||||

| Nov. 30 | By Rent A/c | 2,500 | |||||

| Nov. 30 | By Salary A/c | 3,500 | |||||

| Nov. 30 | By Bank A/c | 8,000 | |||||

| Nov. 30 | By Balance c/d | 23,400 | |||||

| 88,200 | 88,200 | ||||||

| Dec. 01 | To Balance b/d | 23,400 |

Posting from Single Column Cash Book

Since the cash book itself serves as the Cash Account, only the other accounts involved in the transactions need to be posted to the ledger. All accounts on the debit (receipts) side of the cash book are credited in the ledger, and all accounts on the credit (payments) side are debited in the ledger.

Here is the posting for the above example:

Gurmeet's Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Nov. 04 | By Cash A/c | 12,000 |

Sales Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Nov. 16 | By Cash A/c | 28,000 | |||||

| Nov. 27 | By Cash A/c | 18,200 |

Insurance Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Nov. 08 | To Cash A/c | 6,000 |

Furniture Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Nov. 13 | To Cash A/c | 13,800 |

Purchases Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Nov. 17 | To Cash A/c | 17,400 |

Stationery Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Nov. 20 | To Cash A/c | 1,100 |

Rukmani's Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Nov. 24 | To Cash A/c | 12,500 |

Rent Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Nov. 30 | To Cash A/c | 2,500 |

Salary Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Nov. 30 | To Cash A/c | 3,500 |

Bank Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Nov. 30 | To Cash A/c | 8,000 |

Double Column Cash Book

As a business grows, transactions involving a bank account—such as payments by cheque, deposits, and direct bank transfers—become increasingly common. A Single Column Cash Book is insufficient for tracking these activities. To manage both cash and bank transactions efficiently within a single book, a Double Column Cash Book is maintained. This cash book has two amount columns on each side: one for 'Cash' and one for 'Bank'.

This format provides a comprehensive view of the liquidity position of the business at a glance, showing both the cash in hand and the balance at the bank.

Banking Transactions and Instruments

Understanding common banking instruments is essential for maintaining a Double Column Cash Book.

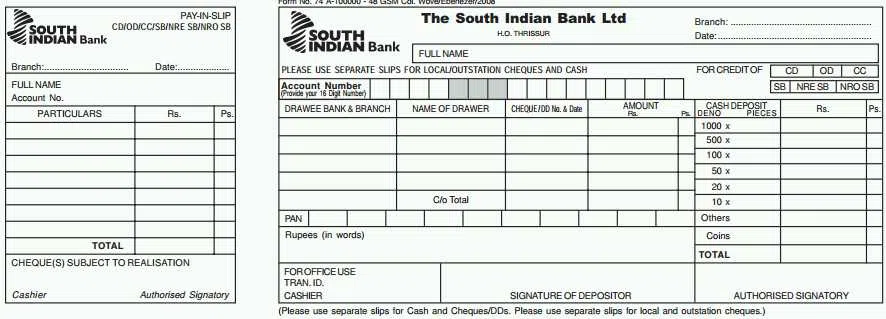

Pay-in-Slip

A Pay-in-Slip is a form provided by the bank, used to deposit cash or cheques into a bank account. It has two parts: the main slip which the bank keeps, and a counterfoil which is stamped and returned to the depositor as a receipt and source document.

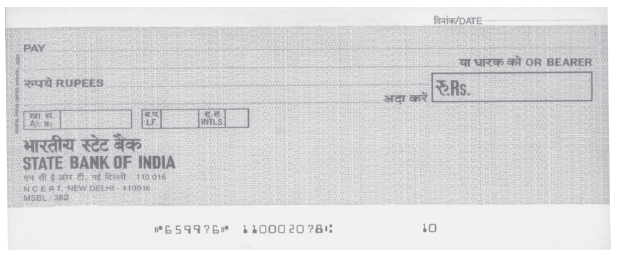

Cheque

A Cheque is a written order directing a bank to pay a specified sum of money to the person named on it (the payee). Cheques can be 'bearer' (payable to whoever presents it) or 'order' (payable only to the specified person or their order).

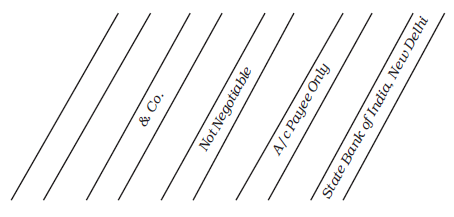

Crossed Cheque

Drawing two parallel transverse lines on the top-left corner of a cheque is called crossing. A crossed cheque cannot be encashed over the counter; it must be deposited into a bank account. This provides security. Special crossings like 'A/c Payee' ensure the amount is only credited to the account of the named payee.

Contra Entries

A Contra Entry is a special type of transaction that involves both the cash and bank accounts, which are part of the same cash book. Since both aspects of the transaction (debit and credit) are recorded within the cash book itself, it does not require posting to any external ledger account.

To identify a contra entry, the letter 'C' is written in the L.F. (Ledger Folio) column on both sides of the cash book.

The two primary contra entries are:

-

Cash deposited into the bank:

- Bank balance increases, so the Bank column is debited.

- Cash balance decreases, so the Cash column is credited.

-

Cash withdrawn from the bank for office use:

- Cash balance increases, so the Cash column is debited.

- Bank balance decreases, so the Bank column is credited.

Special Cases in Double Column Cash Book

Handling of Cheques Received

-

If a cheque is deposited into the bank on the same day it is received: It is treated as a direct bank receipt. The amount is entered directly in the Bank column on the debit side.

-

If a cheque is not deposited on the same day: On the day of receipt, the cheque is treated as 'Cash'. The amount is entered in the Cash column on the debit side. When this cheque is later deposited into the bank, a contra entry is passed (Bank A/c Dr. to Cash A/c).

Dishonour of a Cheque

When a cheque deposited into the bank is returned unpaid by the customer's bank (e.g., due to insufficient funds), it is said to be dishonoured. To record this, the entry is reversed: the Bank column on the credit side is credited, and the customer's personal account is debited in the Journal Proper.

Bank Charges and Interest

- Bank Charges/Interest on Overdraft: When the bank deducts charges, the bank balance decreases. This is recorded on the credit side in the Bank column.

- Interest Collected by Bank: When the bank collects interest or dividends on our behalf, the bank balance increases. This is recorded on the debit side in the Bank column.

Example. Prepare a Double Column Cash Book for M/s Tools India from the following transactions for September 2017.

- Sept. 01: Bank balance ₹ 42,000, Cash balance ₹ 15,000

- Sept. 04: Purchased goods by cheque ₹ 12,000

- Sept. 08: Sales of goods for cash ₹ 6,000

- Sept. 16: Sold goods and received cheque (deposited same day) ₹ 4,500

- Sept. 17: Purchased goods from Mridula in cash ₹ 17,400

- Sept. 24: Cheque given to Rohit ₹ 1,500

- Sept. 27: Cash withdrawn from bank for office use ₹ 10,000

- Sept. 30: Rent paid by cheque ₹ 2,500

- Sept. 30: Paid salary ₹ 3,500

Answer:

M/s Tools India

Cash Book

Dr. (Receipts) Cr. (Payments)

| Date | Particulars | L.F. | Cash (₹) | Bank (₹) | Date | Particulars | L.F. | Cash (₹) | Bank (₹) |

|---|---|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||||

| Sep. 01 | To Balance b/d | 15,000 | 42,000 | Sep. 04 | By Purchases A/c | 12,000 | |||

| Sep. 08 | To Sales A/c | 6,000 | Sep. 17 | By Purchases A/c | 17,400 | ||||

| Sep. 16 | To Sales A/c | 4,500 | Sep. 24 | By Rohit's A/c | 1,500 | ||||

| Sep. 27 | To Bank A/c | C | 10,000 | Sep. 27 | By Cash A/c | C | 10,000 | ||

| Sep. 30 | By Rent A/c | 2,500 | |||||||

| Sep. 30 | By Salary A/c | 3,500 | |||||||

| Sep. 30 | By Balance c/d | 10,100 | 16,500 | ||||||

| 31,000 | 46,500 | 31,000 | 46,500 | ||||||

| Oct. 01 | To Balance b/d | 10,100 | 16,500 |

Ledger Posting

The contra entries (marked 'C') are internal transfers between cash and bank, so they are not posted to any external ledger account. All other entries are posted to their respective ledger accounts.

Purchases Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Sep. 04 | To Bank A/c | 12,000 | |||||

| Sep. 17 | To Cash A/c | 17,400 |

Sales Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Sep. 08 | By Cash A/c | 6,000 | |||||

| Sep. 16 | By Bank A/c | 4,500 |

Rohit's Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Sep. 24 | To Bank A/c | 1,500 |

Rent Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Sep. 30 | To Bank A/c | 2,500 |

Salary Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Sep. 30 | To Cash A/c | 3,500 |

Petty Cash Book

In any large organization, the main cashier is often burdened with a high volume of small, frequent, and repetitive payments. These can include expenses like taxi fares, bus fares, postage, courier charges, stationery, and refreshments. These are collectively known as "petty expenses". Recording each of these minor transactions in the main cash book is not only cumbersome and time-consuming but also makes the main cash book unnecessarily bulky and difficult to audit.

To solve this problem, businesses maintain a separate cash book to record these petty expenses, known as the Petty Cash Book. This book is managed by a junior cashier, designated as the Petty Cashier.

The Imprest System of Petty Cash

The Petty Cash Book is most effectively managed using the Imprest System. "Imprest" refers to a fixed sum of money advanced to the petty cashier to meet petty expenses for a specific period. This system operates in a cyclical manner, ensuring both control and convenience.

Steps in the Imprest System

-

Establishment of the Fund: At the beginning of a period (e.g., a week or a month), the head cashier estimates the total petty expenses and gives a fixed round sum of money to the petty cashier. This amount is known as the imprest amount or float. The journal entry in the main books is:

Petty Cash A/c Dr.

To Cash/Bank A/c -

Making Payments: The petty cashier makes all small payments out of this imprest amount. For every payment made, a supporting voucher (e.g., a bill, receipt) is obtained. These payments are recorded chronologically in the Petty Cash Book, which has multiple analytical columns for different types of expenses.

-

Reimbursement: At the end of the period, or when the imprest amount is nearly exhausted, the petty cashier balances the book and prepares a summary of all expenses. This summary, along with the supporting vouchers, is submitted to the head cashier for verification.

-

Restoring the Imprest: The head cashier checks the records and reimburses the exact amount that was spent by the petty cashier. This reimbursement restores the petty cashier's cash balance to the original imprest amount, ready for the next period. The journal entry for reimbursement debits the various expense heads and credits the main cash/bank account.

Advantages of a Petty Cash Book

-

Saves Time and Effort: It significantly reduces the workload of the main cashier, allowing them to focus on major receipts and payments. It also keeps the main cash book concise and free from numerous minor entries.

-

Effective Control over Expenses: The imprest system provides excellent control. The fixed imprest amount limits the funds available for petty expenses. Regular checking of the petty cashier's records by the head cashier helps prevent misuse of funds and errors.

-

Convenient Recording and Posting: The analytical columns provide a ready classification of expenses. Instead of posting every individual payment to the ledger, only the periodic totals of each expense column are posted to the respective ledger accounts. This saves a great deal of time and effort in ledger posting.

Example. Mr. Mohit, the petty cashier of M/s Samaira Traders, received ₹2,000 on May 01, 2017, from the Head Cashier. Prepare the Petty Cash Book for the month from the following details.

- May 02: Auto fare ₹ 55

- May 03: Courier services ₹ 40

- May 04: Postal stamps ₹ 105

- May 05: Stationery (Erasers, Pencils) ₹ 225

- May 08: Taxi fare ₹ 195

- May 10: Auto fare ₹ 60

- May 16: Computer stationery ₹ 165

- May 20: Office sanitation ₹ 60

- May 29: Unloading charges (Cartage) ₹ 40

Answer:

Petty Cash Book of M/s Samaira Traders

| Amount Received (₹) | Date | Voucher No. | Particulars | Total Paid (₹) | Analysis of Payments | |||

|---|---|---|---|---|---|---|---|---|

| Postage & Courier (₹) | Conveyance (₹) | Stationery (₹) | Miscellaneous (₹) | |||||

| 2017 | ||||||||

| 2,000 | May 01 | To Cash A/c (Received) | ||||||

| May 02 | By Auto fare | 55 | 55 | |||||

| May 03 | By Courier services | 40 | 40 | |||||

| May 04 | By Postal stamps | 105 | 105 | |||||

| May 05 | By Stationery | 225 | 225 | |||||

| May 08 | By Taxi fare | 195 | 195 | |||||

| May 10 | By Auto fare | 60 | 60 | |||||

| May 16 | By Computer stationery | 165 | 165 | |||||

| May 20 | By Office sanitation | 60 | 60 | |||||

| May 29 | By Unloading charges | 40 | 40 | |||||

| Total Expenses | 945 | 145 | 310 | 390 | 100 | |||

| May 31 | By Balance c/d | 1,055 | ||||||

| 2,000 | 2,000 | |||||||

| 1,055 | Jun 01 | To Balance b/d | ||||||

| 945 | Jun 01 | To Cash A/c (Reimbursement) | ||||||

Journal Entries

| Date | Particulars | L.F. | Debit Amount (₹) | Credit Amount (₹) |

|---|---|---|---|---|

| 2017 | ||||

| May 01 | Petty Cash A/cDr. | 2,000 | ||

| To Cash A/c | 2,000 | |||

| (Being cash received to establish the petty cash fund) | ||||

| May 31 | Postage & Courier A/cDr. | 145 | ||

| Conveyance A/cDr. | 310 | |||

| Stationery A/cDr. | 390 | |||

| Miscellaneous Expenses A/cDr. | 100 | |||

| To Petty Cash A/c | 945 | |||

| (Being petty expenses for the month of May recorded) | ||||

| Jun 01 | Petty Cash A/cDr. | 945 | ||

| To Cash A/c | 945 | |||

| (Being cash received to reimburse the petty expenses under imprest system) |

Ledger Postings

Cash Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| May 01 | By Petty Cash A/c | 2,000 | |||||

| Jun 01 | By Petty Cash A/c | 945 |

Petty Cash Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| May 01 | To Cash A/c | 2,000 | May 31 | By Sundry Expenses* | 945 | ||

| May 31 | By Balance c/d | 1,055 | |||||

| 2,000 | 2,000 | ||||||

| Jun 01 | To Balance b/d | 1,055 | |||||

| Jun 01 | To Cash A/c | 945 |

Postage & Courier Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| May 31 | To Petty Cash A/c | 145 |

Conveyance Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| May 31 | To Petty Cash A/c | 310 |

Stationery Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| May 31 | To Petty Cash A/c | 390 |

Miscellaneous Expenses Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| May 31 | To Petty Cash A/c | 100 |

Purchases (Journal) Book

The Purchases Book, also known as the Purchases Journal or Invoice Book, is a special purpose subsidiary book used to record all credit purchases of goods. The term 'goods' specifically refers to the items or merchandise in which the business deals, i.e., items purchased with the intention of resale. Maintaining this book helps in quick, efficient, and accurate recording of voluminous and repetitive purchase transactions.

Understanding the Purchases Book (Without GST)

Initially, we will understand the working of a Purchases Book in a non-GST environment, which focuses purely on the cost of goods purchased.

Scope of the Purchases Book

It is crucial to understand what is recorded in the Purchases Book and what is excluded to maintain accounting accuracy.

-

What is Recorded: This book is exclusively for recording the purchase of goods on credit. For example, for a furniture dealer, the credit purchase of chairs and tables for resale is recorded here.

-

What is NOT Recorded:

- Cash Purchases of Goods: Any purchase of goods made in cash is recorded directly in the Cash Book (on the payments/credit side).

- Credit Purchases of Assets: The purchase of any asset other than goods (e.g., machinery, furniture for office use, computers) on credit is recorded in the Journal Proper.

- Cash Purchases of Assets: These transactions are also recorded in the Cash Book.

Source Document & Format

The primary source document for recording an entry is the Purchase Invoice received from the supplier. Entries are made for the net amount of the invoice, which is the amount after deducting any Trade Discount. It's important to note that Trade Discount is shown as a deduction in the invoice but is not recorded as a separate account in the books of accounts.

Purchases Book (Simple Format)

| Date | Invoice No. | Name of Supplier (Account to be Credited) | L.F. | Amount (₹) |

|---|---|---|---|---|

Posting from the Purchases Book

Posting from the Purchases Book to the ledger is a systematic process:

- Individual Posting: Each transaction is posted to the credit side of the respective supplier's personal account in the ledger. This is usually done daily.

- Periodic Posting: At the end of a specific period (usually a month), the 'Amount' column of the Purchases Book is totaled. This total is posted to the debit side of the Purchases Account.

Example 1 (Without GST). Prepare the Purchases Book for M/s. Premier Garments, Mumbai, for October 2017 from the following transactions and post them to the ledger.

- Oct 01: Purchased goods on credit from 'Surat Textiles' (Invoice No. 450): 100 meters of Silk @ ₹800/meter; 200 meters of Cotton @ ₹300/meter. Trade Discount 10%.

- Oct 04: Purchased goods for cash from 'Local Fabrics' for ₹15,000.

- Oct 07: Purchased from 'Delhi Woolens' on credit (Invoice No. 812): 50 Shawls @ ₹1,200 each.

- Oct 10: Purchased a sewing machine on credit from 'Usha Machines Ltd.' for ₹25,000 (Invoice No. UM-77).

- Oct 12: Purchased from 'Rajasthan Prints' on credit (Invoice No. 333): 80 Kurtis @ ₹500 each. Trade Discount 5%.

- Oct 15: Purchased goods from 'Surat Textiles' on credit (Invoice No. 498): 300 meters of Cotton @ ₹310/meter.

- Oct 18: Bought packing materials on credit from 'Packers Point' for ₹5,000.

- Oct 21: Purchased from 'Fashion Forward Inc.' on credit (Invoice No. 2021): 40 Designer Jackets @ ₹2,500 each. Trade Discount 15%.

- Oct 25: Purchased goods from 'Delhi Woolens' on credit (Invoice No. 855): 20 Sweaters @ ₹900 each.

- Oct 28: Purchased from 'Kolkata Silks' on credit (Invoice No. K-90): 50 Silk Sarees @ ₹4,000 each. Trade Discount 20%.

- Oct 30: Purchased from 'Rajasthan Prints' on credit (Invoice No. 390): 100 Skirts @ ₹450 each.

Answer:

Analysis of Transactions:

- Transactions to be recorded in Purchases Book: The transactions dated Oct 01, 07, 12, 15, 21, 25, 28, and 30 are credit purchases of goods, which M/s. Premier Garments deals in. These will be entered in the Purchases Book.

- Transactions to be excluded from Purchases Book:

- Oct 04: This is a cash purchase of goods and will be recorded in the Cash Book.

- Oct 10: A sewing machine is an asset for the business, not goods for resale. This credit purchase of an asset will be recorded in the Journal Proper.

- Oct 18: Packing materials are an expense, not goods. This credit purchase will also be recorded in the Journal Proper.

Purchases Book of M/s. Premier Garments

| Date | Invoice No. | Name of Supplier | L.F. | Amount (₹) |

|---|---|---|---|---|

| 2017 | ||||

| Oct. 01 | 450 | Surat Textiles (Silk 80,000 + Cotton 60,000 = 1,40,000 Less 10% TD) |

1,26,000 | |

| Oct. 07 | 812 | Delhi Woolens (50 Shawls @ ₹1,200) |

60,000 | |

| Oct. 12 | 333 | Rajasthan Prints (80 Kurtis @ ₹500 = 40,000 Less 5% TD) |

38,000 | |

| Oct. 15 | 498 | Surat Textiles (300m Cotton @ ₹310) |

93,000 | |

| Oct. 21 | 2021 | Fashion Forward Inc. (40 Jackets @ ₹2,500 = 1,00,000 Less 15% TD) |

85,000 | |

| Oct. 25 | 855 | Delhi Woolens (20 Sweaters @ ₹900) |

18,000 | |

| Oct. 28 | K-90 | Kolkata Silks (50 Sarees @ ₹4,000 = 2,00,000 Less 20% TD) |

1,60,000 | |

| Oct. 30 | 390 | Rajasthan Prints (100 Skirts @ ₹450) |

45,000 | |

| Oct. 31 | Total to Purchases A/c (Dr.) | 6,25,000 |

Journal Proper Entries (for excluded transactions)

Journal Entries

| Date | Particulars | L.F. | Debit Amount (₹) | Credit Amount (₹) |

|---|---|---|---|---|

| 2017 | ||||

| Oct. 10 | Machinery A/cDr. | 25,000 | ||

| To Usha Machines Ltd. A/c | 25,000 | |||

| (Being sewing machine purchased on credit) | ||||

| Oct. 18 | Packing Materials Expense A/cDr. | 5,000 | ||

| To Packers Point A/c | 5,000 | |||

| (Being packing materials purchased on credit) |

Ledger Posting

Surat Textiles Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Oct. 01 | By Purchases A/c | 1,26,000 | |||||

| Oct. 15 | By Purchases A/c | 93,000 |

Delhi Woolens Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Oct. 07 | By Purchases A/c | 60,000 | |||||

| Oct. 25 | By Purchases A/c | 18,000 |

Rajasthan Prints Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Oct. 12 | By Purchases A/c | 38,000 | |||||

| Oct. 30 | By Purchases A/c | 45,000 |

Fashion Forward Inc. Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Oct. 21 | By Purchases A/c | 85,000 |

Kolkata Silks Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Oct. 28 | By Purchases A/c | 1,60,000 |

Purchases Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Oct. 31 | To Sundries as per Purchases Book | 6,25,000 |

Incorporating Goods and Services Tax (GST)

In the current business environment, most transactions are subject to GST. This requires a more detailed or 'analytical' Purchases Book to account for the tax component correctly.

How GST is Treated in Accounting

GST paid on the purchase of goods or services is known as Input GST. For the business, Input GST is treated as an asset because the business can claim this amount as a credit to reduce its final GST liability payable to the government (which arises from GST collected on sales, known as Output GST).

- Intra-State Purchase (within the same state): The GST is split into two parts: CGST (Central GST) and SGST (State GST). The business will pay and record Input CGST and Input SGST.

- Inter-State Purchase (from another state): A single tax, IGST (Integrated GST), is levied. The business will pay and record Input IGST.

Analytical Purchases Book with GST (Format)

To accommodate GST, separate columns are added for each type of Input GST. The total invoice value now includes the cost of goods plus the applicable GST.

| Date | Invoice No. | Name of Supplier | L.F. | Purchases (Cost) (₹) | Input CGST (₹) | Input SGST (₹) | Input IGST (₹) | Total Amount (₹) |

|---|---|---|---|---|---|---|---|---|

Posting from the Analytical Purchases Book

The posting process is expanded:

- Individual Posting: The respective supplier's account is credited with the amount from the 'Total Amount' column.

- Periodic Posting: The totals of the various columns are posted as follows:

- Total of 'Purchases (Cost)' column is debited to the Purchases Account.

- Total of 'Input CGST' column is debited to the Input CGST Account.

- Total of 'Input SGST' column is debited to the Input SGST Account.

- Total of 'Input IGST' column is debited to the Input IGST Account.

Example 2 (With GST). Prepare the Purchases Book for M/s. BANSAL ELECTRONICS, Delhi, for September 2017. Applicable GST rates are CGST @ 9%, SGST @ 9%, and IGST @ 18%.

- Sep 02: Purchased from M/s Ahuja Electronics, Delhi (Invoice No. 101): 10 Music Systems @ ₹8,000 each. Trade Discount @ 15%.

- Sep 08: Purchased from M/s Punjab Traders, Ludhiana (Invoice No. 234): 50 LED TVs @ ₹12,000 each. Trade Discount @ 20%.

- Sep 16: Purchased from M/s Jindal & Sons, Delhi (Invoice No. 567): 100 Mobile Chargers @ ₹250 each.

Answer:

Books of M/s. BANSAL ELECTRONICS, Delhi

Purchases (Journal) Book

| Date | Invoice No. | Name of Supplier | L.F. | Purchases (₹) | Input CGST (₹) | Input SGST (₹) | Input IGST (₹) | Total Amount (₹) |

|---|---|---|---|---|---|---|---|---|

| 2017 | ||||||||

| Sep. 02 | 101 | M/s Ahuja Electronics, Delhi (80,000 - 15% TD = 68,000) |

68,000 | 6,120 | 6,120 | - | 80,240 | |

| Sep. 08 | 234 | M/s Punjab Traders, Ludhiana (6,00,000 - 20% TD = 4,80,000) |

4,80,000 | - | - | 86,400 | 5,66,400 | |

| Sep. 16 | 567 | M/s Jindal & Sons, Delhi (100 chargers @ 250 = 25,000) |

25,000 | 2,250 | 2,250 | - | 29,500 | |

| Sep. 30 | Total | 5,73,000 | 8,370 | 8,370 | 86,400 | 6,76,140 |

Working Notes:

| Particulars | Amount (₹) |

|---|---|

| List Price of 10 Music Systems @ $\textsf{₹ }$ 8,000 | 80,000 |

| Less: Trade Discount @ 15% ($\textsf{₹ } 80,000 \times 0.15$) | (12,000) |

| Net Purchase Value | 68,000 |

| Add: Input CGST @ 9% ($\textsf{₹ } 68,000 \times 0.09$) | 6,120 |

| Add: Input SGST @ 9% ($\textsf{₹ } 68,000 \times 0.09$) | 6,120 |

| Total Invoice Amount | 80,240 |

| Particulars | Amount (₹) |

|---|---|

| List Price of 50 LED TVs @ $\textsf{₹ }$ 12,000 | 6,00,000 |

| Less: Trade Discount @ 20% ($\textsf{₹ } 6,00,000 \times 0.20$) | (1,20,000) |

| Net Purchase Value | 4,80,000 |

| Add: Input IGST @ 18% ($\textsf{₹ } 4,80,000 \times 0.18$) | 86,400 |

| Total Invoice Amount | 5,66,400 |

| Particulars | Amount (₹) |

|---|---|

| List Price of 100 Chargers @ $\textsf{₹ }$ 250 | 25,000 |

| Net Purchase Value (No Trade Discount) | 25,000 |

| Add: Input CGST @ 9% ($\textsf{₹ } 25,000 \times 0.09$) | 2,250 |

| Add: Input SGST @ 9% ($\textsf{₹ } 25,000 \times 0.09$) | 2,250 |

| Total Invoice Amount | 29,500 |

Ledger Posting

Individual supplier accounts are credited with their total invoice amounts. At the end of the month, the column totals are debited to their respective accounts in the general ledger.

M/s Ahuja Electronics Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Sep. 02 | By Purchases A/c | 80,240 |

M/s Punjab Traders Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Sep. 08 | By Purchases A/c | 5,66,400 |

M/s Jindal & Sons Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Sep. 16 | By Purchases A/c | 29,500 |

Purchases Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Sep. 30 | To Sundries as per Purchases Book | 5,73,000 |

Input CGST Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Sep. 30 | To Sundries as per Purchases Book | 8,370 |

Input SGST Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Sep. 30 | To Sundries as per Purchases Book | 8,370 |

Input IGST Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Sep. 30 | To Sundries as per Purchases Book | 86,400 |

Purchases Return (Return Outwards) Book

The Purchases Return Book, also known as the Return Outwards Book, is a special purpose subsidiary book used to record the return of goods that were originally purchased on credit. When goods are returned to a supplier, they are moving 'outward' from the business, which is why it is also called the Return Outwards Book.

Goods may be returned for various reasons, such as:

- They are defective or of substandard quality.

- They were damaged in transit.

- They do not match the sample or description based on which the order was placed.

- They are the wrong items or in excess of the quantity ordered.

Like the Purchases Book, this book only records the return of goods. The return of an asset purchased on credit (e.g., returning a faulty piece of furniture) is recorded in the Journal Proper.

Source Document: The Debit Note

When a business returns goods to a supplier, it prepares a document called a Debit Note and sends the original copy to the supplier. A Debit Note is a formal document that serves as an intimation to the supplier that their account is being debited by the business for the value of the goods returned. This debit reduces the amount owed to the supplier.

A Debit Note is the primary source document for making entries in the Purchases Return Book. It typically contains the supplier's name, a unique serial number, date, details of the goods being returned, a reference to the original purchase invoice, and the reason for the return.

Purchases Return Book (Without GST)

First, we will understand the format and posting in a non-GST environment, where the focus is solely on the value of the goods being returned.

Format of Purchases Return Book

| Date | Debit Note No. | Name of Supplier (Account to be Debited) | L.F. | Amount (₹) |

|---|---|---|---|---|

Posting from Purchases Return Book

The posting process is the reverse of posting from the Purchases Book:

- Individual Posting: Each entry is posted to the debit side of the respective supplier's account in the ledger. This reduces the balance payable to that supplier. This is typically done daily.

- Periodic Posting: The periodic total of the Purchases Return Book (usually at the end of the month) is posted to the credit side of the Purchases Return Account in the ledger. The Purchases Return account is a contra-expense account that reduces the total purchases.

Example 1 (Without GST). Prepare the Purchases Return Book of M/s. Premier Garments, Mumbai, for October 2017 from the following transactions and post them into the ledger. (Refer to the purchases made in the previous example).

- Oct 03: Returned 10 meters of defective Silk to 'Surat Textiles' (Debit Note No. 101). The silk was purchased @ ₹800/meter, with a 10% trade discount.

- Oct 09: Returned 5 shawls to 'Delhi Woolens' as they were not as per sample (Debit Note No. 102). The shawls were purchased @ ₹1,200 each.

- Oct 13: Returned 4 Kurtis to 'Rajasthan Prints' (Debit Note No. 103). They were purchased @ ₹500 each, with a 5% trade discount.

- Oct 14: The sewing machine purchased from 'Usha Machines Ltd.' was found faulty and returned.

- Oct 17: Returned 20 meters of cotton to 'Surat Textiles' (Debit Note No. 104). It was purchased @ ₹310/meter.

- Oct 20: Returned packing materials worth ₹500 to 'Packers Point'.

- Oct 23: Returned 3 Designer Jackets to 'Fashion Forward Inc.' (Debit Note No. 105). They were purchased @ ₹2,500 each, with a 15% trade discount.

- Oct 27: Returned 2 Sweaters to 'Delhi Woolens' (Debit Note No. 106). They were purchased @ ₹900 each.

- Oct 29: Returned 5 Silk Sarees to 'Kolkata Silks' (Debit Note No. 107). They were purchased @ ₹4,000 each, with a 20% trade discount.

- Oct 31: Returned 10 Skirts to 'Rajasthan Prints' (Debit Note No. 108). They were purchased @ ₹450 each.

Answer:

Analysis of Transactions:

- All transactions except those on Oct 14 and Oct 20 involve the return of 'goods' that were purchased on credit. These will be recorded in the Purchases Return Book.

- Oct 14 & 20: The return of the sewing machine (an asset) and packing materials (an expense) are not returns of 'goods for resale'. Therefore, these will be recorded in the Journal Proper.

Purchases Return Book of M/s. Premier Garments

| Date | Debit Note No. | Name of Supplier | L.F. | Amount (₹) |

|---|---|---|---|---|

| 2017 | ||||

| Oct. 03 | 101 | Surat Textiles (8,000 - 10% TD) |

7,200 | |

| Oct. 09 | 102 | Delhi Woolens (5 Shawls @ ₹1,200) |

6,000 | |

| Oct. 13 | 103 | Rajasthan Prints (2,000 - 5% TD) |

1,900 | |

| Oct. 17 | 104 | Surat Textiles (20m Cotton @ ₹310) |

6,200 | |

| Oct. 23 | 105 | Fashion Forward Inc. (7,500 - 15% TD) |

6,375 | |

| Oct. 27 | 106 | Delhi Woolens (2 Sweaters @ ₹900) |

1,800 | |

| Oct. 29 | 107 | Kolkata Silks (20,000 - 20% TD) |

16,000 | |

| Oct. 31 | 108 | Rajasthan Prints (10 Skirts @ ₹450) |

4,500 | |

| Oct. 31 | Total to Purchases Return A/c (Cr.) | 49,975 |

Ledger Posting

Surat Textiles Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Oct. 03 | To Purchases Return A/c | 7,200 | |||||

| Oct. 17 | To Purchases Return A/c | 6,200 |

Delhi Woolens Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Oct. 09 | To Purchases Return A/c | 6,000 | |||||

| Oct. 27 | To Purchases Return A/c | 1,800 |

Purchases Return Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Oct. 31 | By Sundries as per P. Ret. Book | 49,975 |

Purchases Return Book (With GST)

When goods are returned in a GST environment, the Input GST credit claimed at the time of purchase must also be reversed. The Purchases Return Book must, therefore, have columns to record this reversal.

Reversal of Input Tax Credit (ITC)

When goods are returned, the business is no longer entitled to the Input Tax Credit (ITC) it claimed on those goods. This credit must be reversed. The reversal is done by crediting the respective Input GST accounts (Input CGST, Input SGST, or Input IGST), effectively cancelling the original debit entry made at the time of purchase.

Analytical Purchases Return Book with GST (Format)

| Date | Debit Note No. | Name of Supplier | L.F. | Purchases Return (₹) | Input CGST (₹) | Input SGST (₹) | Input IGST (₹) | Total Amount (₹) |

|---|---|---|---|---|---|---|---|---|

Posting from Analytical Purchases Return Book

- Individual Posting: The supplier's account is debited with the total amount from the 'Total Amount' column.

- Periodic Posting: The column totals are posted as follows:

- Total of 'Purchases Return' column is credited to the Purchases Return Account.

- Total of 'Input CGST' column is credited to the Input CGST Account.

- Total of 'Input SGST' column is credited to the Input SGST Account.

- Total of 'Input IGST' column is credited to the Input IGST Account.

Example 2 (With GST). From the following details of M/s. BANSAL ELECTRONICS, Delhi, prepare the Purchases Return Book for September 2017. Applicable GST: CGST @9%, SGST @9%, IGST @18%.

- Sep. 10: Returned one Music System to M/s Ahuja Electronics, Delhi (Debit Note No. 51). The original purchase price was ₹8,000, less 15% Trade Discount.

- Sep. 15: Returned two defective LED TVs to M/s Punjab Traders, Ludhiana (Debit Note No. 52). Original purchase price was ₹12,000 per TV, less 20% Trade Discount.

Answer:

The Purchases Return Book (also known as the Return Outwards Journal) is a subsidiary book used to record the return of goods previously purchased on credit. When goods are returned, the Input Tax Credit (ITC) claimed at the time of purchase must be reversed.

Since M/s. BANSAL ELECTRONICS is based in Delhi:

- Returns to a Delhi supplier (Intra-State) will reverse Input CGST and Input SGST.

- Returns to an out-of-state supplier like Ludhiana, Punjab (Inter-State) will reverse Input IGST.

Books of M/s. BANSAL ELECTRONICS, Delhi

Purchases Return (Journal) Book

| Date | Debit Note No. | Name of Supplier | L.F. | Purchases Return (₹) | Input CGST (₹) | Input SGST (₹) | Input IGST (₹) | Total Amount (₹) |

|---|---|---|---|---|---|---|---|---|

| 2017 | ||||||||

| Sep. 10 | 51 | M/s Ahuja Electronics, Delhi (8,000 - 15% TD = 6,800) |

6,800 | 612 | 612 | - | 8,024 | |

| Sep. 15 | 52 | M/s Punjab Traders, Ludhiana (2 TVs @ 12,000 = 24,000 - 20% TD = 19,200) |

19,200 | - | - | 3,456 | 22,656 | |

| Sep. 30 | Total | 26,000 | 612 | 612 | 3,456 | 30,680 |

Working Notes:

| Particulars | Amount (₹) |

|---|---|

| List Price of 1 Music System | 8,000 |

| Less: Trade Discount @ 15% ($\textsf{₹ } 8,000 \times 0.15$) | (1,200) |

| Value of Goods Returned (Purchases Return) | 6,800 |

| Add: Reversed Input CGST @ 9% ($\textsf{₹ } 6,800 \times 0.09$) | 612 |

| Add: Reversed Input SGST @ 9% ($\textsf{₹ } 6,800 \times 0.09$) | 612 |

| Total Amount (Debited to Supplier) | 8,024 |

| Particulars | Amount (₹) |

|---|---|

| List Price of 2 LED TVs @ $\textsf{₹ }$ 12,000 each | 24,000 |

| Less: Trade Discount @ 20% ($\textsf{₹ } 24,000 \times 0.20$) | (4,800) |

| Value of Goods Returned (Purchases Return) | 19,200 |

| Add: Reversed Input IGST @ 18% ($\textsf{₹ } 19,200 \times 0.18$) | 3,456 |

| Total Amount (Debited to Supplier) | 22,656 |

Ledger Posting

Individual supplier accounts are debited with the total amount from the debit note. At the end of the month, the column totals for Purchases Return and GST accounts are credited in the general ledger.

M/s Ahuja Electronics Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Sep. 10 | To Purchases Return A/c | 8,024 |

M/s Punjab Traders Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Sep. 15 | To Purchases Return A/c | 22,656 |

Purchases Return Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Sep. 30 | By Sundries as per P. Ret. Book | 26,000 |

Input CGST Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Sep. 30 | By Sundries as per P. Ret. Book | 612 |

Input SGST Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Sep. 30 | By Sundries as per P. Ret. Book | 612 |

Input IGST Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Sep. 30 | By Sundries as per P. Ret. Book | 3,456 |

Sales (Journal) Book

The Sales Book (or Sales Journal) is a special purpose subsidiary book maintained to record all credit sales of goods. It functions as a chronological record of credit sales, helping to simplify the ledger and make the recording process more efficient. It is the counterpart to the Purchases Book and follows a similar principle of specialization.

Sales Book (Without GST)

We'll first explore the Sales Book in a simple, non-GST context to understand its fundamental mechanics.

Scope of the Sales Book

It is vital to distinguish which transactions belong in the Sales Book:

- What is Recorded: Only the sale of goods on credit. For a bookseller, the credit sale of books is recorded here.

- What is NOT Recorded:

- Cash Sales of Goods: These are recorded on the receipt (debit) side of the Cash Book.

- Credit Sales of Assets: The sale of any asset (e.g., old furniture, used delivery van) on credit is recorded in the Journal Proper.

- Cash Sales of Assets: These are also recorded in the Cash Book.

Source Document and Format

The source document for the Sales Book is the firm's own Sales Invoice. When goods are sold on credit, the seller prepares an invoice, usually in duplicate or triplicate. The original copy is sent to the customer, and a carbon copy is retained. This copy serves as the basis for the entry in the Sales Book.

Sales Book (Simple Format)

| Date | Invoice No. | Name of Customer (Account to be Debited) | L.F. | Amount (₹) |

|---|---|---|---|---|

Posting from the Sales Book

- Individual Posting: Each entry from the Sales Book is posted to the debit side of the respective customer's account in the ledger, as they are now a debtor to the business. This is usually done daily.

- Periodic Posting: The periodic total of the Sales Book (usually monthly) is posted to the credit side of the Sales Account in the ledger, as sales is a revenue for the business.

Example 1 (Without GST). Prepare the Sales Book for M/s. Koina Supplies for April 2017 from the following transactions and post them to the ledger.

- April 01: Sold goods to M/s Raman Traders on credit (Invoice No. 178): 2 water purifiers @ ₹2,100 each; 5 buckets @ ₹130 each.

- April 04: Sold goods for cash to a walk-in customer for ₹5,000.

- April 06: Sold goods to M/s Nutan Enterprises on credit (Invoice No. 180): 5 roadside containers @ ₹4,200 each.

- April 10: Sold old office furniture on credit to M/s. Old Mart for ₹8,000 (Invoice No. OM-01).

- April 12: Sold goods to M/s. Global Traders on credit (Invoice No. 181): 10 water filters @ ₹900 each; 20 large drums @ ₹1,500 each. Trade discount 10%.

- April 18: Sold goods to M/s Raman Traders on credit (Invoice No. 195): 100 big buckets @ ₹85 each.

- April 22: Sold goods to M/s Modern Retailers on credit (Invoice No. 196): 50 water purifiers @ ₹2,200 each. Trade discount 5%.

- April 26: Sold goods to M/s Nutan Enterprises on credit (Invoice No. 201): 20 water filters @ ₹950 each.

- April 30: Sold the old delivery van for ₹75,000 on credit to Mr. Ashok.

Answer:

Analysis of Transactions:

The following points detail which transactions are recorded in the Sales Book and which are not:

The transactions dated April 01, 06, 12, 18, 22, and 26 will be recorded in the Sales Book as they represent the credit sale of goods that the business deals in.

April 04: This is a cash sale of goods. Therefore, it will not be recorded in the Sales Book but will be recorded in the Cash Book.

April 10 & 30: These are credit sales of assets (old furniture and an old delivery van). Since the Sales Book is meant only for recording the credit sale of trade goods, these transactions will be recorded in the Journal Proper.

Sales Book of M/s. Koina Supplies

| Date | Invoice No. | Name of Customer | L.F. | Amount (₹) |

|---|---|---|---|---|

| 2017 | ||||

| Apr. 01 | 178 | M/s Raman Traders (2 Purifiers @ ₹2,100 + 5 Buckets @ ₹130) |

4,850 | |

| Apr. 06 | 180 | M/s Nutan Enterprises (5 containers @ ₹4,200) |

21,000 | |

| Apr. 12 | 181 | M/s. Global Traders (Filters ₹9,000 + Drums ₹30,000 = ₹39,000 Less 10% TD) |

35,100 | |

| Apr. 18 | 195 | M/s Raman Traders (100 buckets @ ₹85) |

8,500 | |

| Apr. 22 | 196 | M/s Modern Retailers (50 purifiers @ ₹2,200 = ₹1,10,000 Less 5% TD) |

1,04,500 | |

| Apr. 26 | 201 | M/s Nutan Enterprises (20 filters @ ₹950) |

19,000 | |

| Apr. 30 | Total to Sales A/c (Cr.) | 1,92,950 |

Ledger Posting

M/s Raman Traders Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Apr. 01 | To Sales A/c | 4,850 | |||||

| Apr. 18 | To Sales A/c | 8,500 |

M/s Nutan Enterprises Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Apr. 06 | To Sales A/c | 21,000 | |||||

| Apr. 26 | To Sales A/c | 19,000 |

M/s. Global Traders Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Apr. 12 | To Sales A/c | 35,100 |

M/s Modern Retailers Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Apr. 22 | To Sales A/c | 1,04,500 |

Sales Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Apr. 30 | By Sundries as per Sales Book | 1,92,950 |

Sales Book with GST

When goods are sold, GST is collected from the customer. This collected GST is known as Output GST and is a liability for the business, as it must be paid to the government after adjusting for Input GST.

- Intra-State Sale (within the same state): Output CGST and Output SGST are collected and recorded.

- Inter-State Sale (to another state): Output IGST is collected and recorded.

Analytical Sales Book with GST (Format)

To record GST properly, an analytical sales book with separate columns for each type of Output GST is used.

| Date | Invoice No. | Name of Customer | L.F. | Sales (Value) (₹) | Output CGST (₹) | Output SGST (₹) | Output IGST (₹) | Total Amount (₹) |

|---|---|---|---|---|---|---|---|---|

Posting from Analytical Sales Book

- Individual Posting: The customer's account is debited with the total invoice amount from the 'Total Amount' column.

- Periodic Posting: The column totals are posted as follows:

- Total of 'Sales (Value)' column is credited to the Sales Account.

- Total of 'Output CGST' column is credited to the Output CGST Account (a liability account).

- Total of 'Output SGST' column is credited to the Output SGST Account.

- Total of 'Output IGST' column is credited to the Output IGST Account.

Example 2 (With GST). Prepare the Sales Book of M/s Vineet Stores, Jaipur (Rajasthan) for December 2017. Applicable GST rates: CGST @ 2.5%, SGST @ 2.5%, IGST @ 5%.

- Dec. 01: Sold goods to M/s Rohit Stores, Ajmer (Invoice No. 325): 30 Kids Books @ ₹60 each; 20 Animal Books @ ₹50 each.

- Dec. 05: Sold goods to M/s Mera Stores, Delhi (Invoice No. 328): 100 Greeting Cards @ ₹12 each; 50 Musical Cards @ ₹50 each. Trade Discount 5%.

- Dec. 10: Sold goods to M/s Mega Stationers, Jaipur (Invoice No. 329): 50 Writing Pads @ ₹20 each; 50 Colour Books @ ₹30 each.

Answer:

Sales Book of M/s. Vineet Stores, Jaipur

| Date | Invoice No. | Name of Customer | L.F. | Sales (₹) | Output CGST @2.5% (₹) | Output SGST @2.5% (₹) | Output IGST @5% (₹) | Total Amount (₹) |

|---|---|---|---|---|---|---|---|---|

| 2017 | ||||||||

| Dec. 01 | 325 | M/s Rohit Stores, Ajmer (Kids Books ₹1,800 + Animal Books ₹1,000) |

2,800.00 | 70.00 | 70.00 | - | 2,940.00 | |

| Dec. 05 | 328 | M/s Mera Stores, Delhi (Gross ₹3,700 - 5% TD = ₹3,515) |

3,515.00 | - | - | 175.75 | 3,690.75 | |

| Dec. 10 | 329 | M/s Mega Stationers, Jaipur (Writing Pads ₹1,000 + Colour Books ₹1,500) |

2,500.00 | 62.50 | 62.50 | - | 2,625.00 | |

| Dec. 31 | Total | 8,815.00 | 132.50 | 132.50 | 175.75 | 9,255.75 |

Working Notes

| Calculation of Invoice Values | |

|---|---|

| 1. Dec 01: M/s Rohit Stores, Ajmer (Intra-State) | |

| Value of Goods (₹1,800 + ₹1,000) | 2,800.00 |

| Add: Output CGST @ 2.5% on ₹2,800 | 70.00 |

| Add: Output SGST @ 2.5% on ₹2,800 | 70.00 |

| Total Invoice Value | 2,940.00 |

| 2. Dec 05: M/s Mera Stores, Delhi (Inter-State) | |

| Value of Goods (₹1,200 + ₹2,500) | 3,700.00 |

| Less: Trade Discount @ 5% on ₹3,700 | (185.00) |

| Taxable Value | 3,515.00 |

| Add: Output IGST @ 5% on ₹3,515 | 175.75 |

| Total Invoice Value | 3,690.75 |

| 3. Dec 10: M/s Mega Stationers, Jaipur (Intra-State) | |

| Value of Goods (₹1,000 + ₹1,500) | 2,500.00 |

| Add: Output CGST @ 2.5% on ₹2,500 | 62.50 |

| Add: Output SGST @ 2.5% on ₹2,500 | 62.50 |

| Total Invoice Value | 2,625.00 |

Ledger Postings

M/s Rohit Stores Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Dec. 01 | To Sales A/c | 2,940.00 |

M/s Mera Stores Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Dec. 05 | To Sales A/c | 3,690.75 |

M/s Mega Stationers Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Dec. 10 | To Sales A/c | 2,625.00 |

Sales Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Dec. 31 | By Sundries (as per Sales Book) | 8,815.00 |

Output CGST Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Dec. 31 | By Sundries (as per Sales Book) | 132.50 |

Output SGST Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Dec. 31 | By Sundries (as per Sales Book) | 132.50 |

Output IGST Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Dec. 31 | By Sundries (as per Sales Book) | 175.75 |

Sales Return (Return Inwards) Book

The Sales Return Book is a special purpose subsidiary book used to record goods returned by customers, which were originally sold to them on credit. Since the returned goods are physically coming 'inward' into the business, this book is also known as the Return Inwards Book.

Just like purchases return, sales returns occur for various reasons, such as goods being defective, damaged, or not conforming to the customer's order. This book only records the return of goods. The return of an asset (e.g., old furniture) that was sold on credit would be recorded through the Journal Proper.

Source Document: The Credit Note

When a customer returns goods, the seller prepares a Credit Note and sends the original copy to the customer. A Credit Note is a formal document indicating that the customer's account has been credited in the seller's books. This credit reduces the total amount receivable from that customer.

Contents of a Credit Note

The Credit Note is the primary source document for recording entries in the Sales Return Book. It generally includes:

- The name and address of the customer whose account is being credited.

- The date of the return.

- A unique, serial Credit Note number.

- Details of the goods received back (quantity, description, rate, and total value).

- A reference to the original sales invoice number.

Sales Return Book (Without GST)

Let's first examine the simple format and posting procedure in a non-GST scenario.

Format of Sales Return Book

| Date | Credit Note No. | Name of Customer (Account to be Credited) | L.F. | Amount (₹) |

|---|---|---|---|---|

Posting from Sales Return Book

The posting process is the opposite of posting from the Sales Book:

- Individual Posting: Each entry is posted to the credit side of the respective customer's account in the ledger. This reduces the amount receivable from the customer.

- Periodic Posting: The periodic total of the Sales Return Book is posted to the debit side of the Sales Return Account in the ledger. The Sales Return account is a contra-revenue account, which is deducted from total sales to arrive at net sales.

Example 1 (Without GST). Prepare the Sales Return Book for M/s. Koina Supplies for April 2017 from the following transactions and post them to the ledger. (Refer to the sales made in the previous example).

- April 03: M/s Raman Traders returned one water purifier sold to them @ ₹2,100 (Credit Note No. 201).

- April 09: M/s Nutan Enterprises returned one roadside container as it was damaged. It was sold for ₹4,200 (Credit Note No. 202).

- April 15: M/s. Global Traders returned 2 large drums, sold to them @ ₹1,500 each, less 10% trade discount (Credit Note No. 203).

- April 18: The old office furniture sold to M/s. Old Mart was returned by them.

- April 20: M/s Raman Traders returned 10 big buckets sold to them @ ₹85 each (Credit Note No. 204).

- April 25: M/s Modern Retailers returned 2 water purifiers sold to them @ ₹2,200 each, less 5% trade discount (Credit Note No. 205).

- April 28: M/s Nutan Enterprises returned 3 water filters sold to them @ ₹950 each (Credit Note No. 206).

Answer:

Analysis of Transactions:

All transactions, except the one on April 18, involve the return of 'goods' that were previously sold on credit. Therefore, these will be recorded in the Sales Return Book (also known as Returns Inward Book).

April 18: This transaction involves the return of old office furniture, which is an asset, not goods for resale. The return of an asset will be recorded in the Journal Proper, not in the Sales Return Book.

Sales Return Book of M/s. Koina Supplies

| Date | Credit Note No. | Name of Customer | L.F. | Amount (₹) |

|---|---|---|---|---|

| 2017 | ||||

| Apr. 03 | 201 | M/s Raman Traders | 2,100 | |

| Apr. 09 | 202 | M/s Nutan Enterprises | 4,200 | |

| Apr. 15 | 203 | M/s. Global Traders (Gross ₹3,000 Less 10% TD) |

2,700 | |

| Apr. 20 | 204 | M/s Raman Traders | 850 | |

| Apr. 25 | 205 | M/s Modern Retailers (Gross ₹4,400 Less 5% TD) |

4,180 | |

| Apr. 28 | 206 | M/s Nutan Enterprises | 2,850 | |

| Apr. 30 | Total to Sales Return A/c (Dr.) | 16,880 |

Ledger Posting

M/s Raman Traders Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Apr. 03 | By Sales Return A/c | 2,100 | |||||

| Apr. 20 | By Sales Return A/c | 850 |

M/s Nutan Enterprises Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Apr. 09 | By Sales Return A/c | 4,200 | |||||

| Apr. 28 | By Sales Return A/c | 2,850 |

M/s. Global Traders Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Apr. 15 | By Sales Return A/c | 2,700 |

M/s Modern Retailers Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Apr. 25 | By Sales Return A/c | 4,180 |

Sales Return Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Apr. 30 | To Sundries as per Sales Return Book | 16,880 |

Sales Return Book with GST

When a customer returns goods, the Output GST that was collected at the time of sale must also be reversed. The business's liability to pay that portion of GST to the government is cancelled.

Reversal of Output GST Liability

To reverse the liability, the respective Output GST accounts (Output CGST, Output SGST, or Output IGST), which were credited at the time of sale, are now debited.

Analytical Sales Return Book with GST (Format)

| Date | Credit Note No. | Name of Customer | L.F. | Sales Return (₹) | Output CGST (₹) | Output SGST (₹) | Output IGST (₹) | Total Amount (₹) |

|---|---|---|---|---|---|---|---|---|

Posting from Analytical Sales Return Book

- Individual Posting: The customer's account is credited with the total amount from the 'Total Amount' column.

- Periodic Posting: The column totals are posted as follows:

- Total of 'Sales Return' column is debited to the Sales Return Account.

- Total of 'Output CGST' column is debited to the Output CGST Account (to reverse the credit).

- Total of 'Output SGST' column is debited to the Output SGST Account.

- Total of 'Output IGST' column is debited to the Output IGST Account.

Example 2 (With GST). Prepare the Sales Return Book of M/s Vineet Stores, Jaipur (Rajasthan) for December 2017. Applicable GST rates: CGST @ 2.5%, SGST @ 2.5%, IGST @ 5%.

- Dec. 15: Goods returned by M/s Rohit Stores, Ajmer (Credit Note No. 201): 2 Kids Books @ ₹60 each; 1 Animal Book @ ₹50 each.

- Dec. 22: Goods returned by M/s Mega Stationers, Jaipur (Credit Note No. 204): 5 Writing Pads @ ₹20 each.

- Dec. 30: Goods returned by M/s Mera Stores, Delhi (Credit Note No. 207): 10 Musical Cards @ ₹50 each, less 5% trade discount.

Answer:

Sales Return Book of M/s. Vineet Stores, Jaipur

| Date | Credit Note No. | Name of Customer | L.F. | Sales Return (₹) | Output CGST @2.5% (₹) | Output SGST @2.5% (₹) | Output IGST @5% (₹) | Total Amount (₹) |

|---|---|---|---|---|---|---|---|---|

| 2017 | ||||||||

| Dec. 15 | 201 | M/s Rohit Stores, Ajmer (₹120 + ₹50 = ₹170) |

170.00 | 4.25 | 4.25 | - | 178.50 | |

| Dec. 22 | 204 | M/s Mega Stationers, Jaipur (5 pads @ ₹20 = ₹100) |

100.00 | 2.50 | 2.50 | - | 105.00 | |

| Dec. 30 | 207 | M/s Mera Stores, Delhi (Gross ₹500 - 5% TD = ₹475) |

475.00 | - | - | 23.75 | 498.75 | |

| Dec. 31 | Total | 745.00 | 6.75 | 6.75 | 23.75 | 782.25 |

Working Notes

| Calculation of Credit Note Values | |

|---|---|

| 1. Dec 15: M/s Rohit Stores, Ajmer (Intra-State) | |

| Value of Goods Returned (₹120 + ₹50) | 170.00 |

| Add: Output CGST @ 2.5% on ₹170 | 4.25 |

| Add: Output SGST @ 2.5% on ₹170 | 4.25 |

| Total Credit Note Value | 178.50 |

| 2. Dec 22: M/s Mega Stationers, Jaipur (Intra-State) | |

| Value of Goods Returned | 100.00 |

| Add: Output CGST @ 2.5% on ₹100 | 2.50 |

| Add: Output SGST @ 2.5% on ₹100 | 2.50 |

| Total Credit Note Value | 105.00 |

| 3. Dec 30: M/s Mera Stores, Delhi (Inter-State) | |

| Value of Goods Returned | 500.00 |

| Less: Trade Discount @ 5% on ₹500 | (25.00) |

| Taxable Value of Return | 475.00 |

| Add: Output IGST @ 5% on ₹475 | 23.75 |

| Total Credit Note Value | 498.75 |

Ledger Postings

M/s Rohit Stores Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Dec. 15 | By Sales Return A/c | 178.50 |

M/s Mega Stationers Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Dec. 22 | By Sales Return A/c | 105.00 |

M/s Mera Stores Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Dec. 30 | By Sales Return A/c | 498.75 |

Sales Return Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Dec. 31 | To Sundries (as per S.R. Book) | 745.00 |

Output CGST Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Dec. 31 | To Sundries (as per S.R. Book) | 6.75 |

Output SGST Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Dec. 31 | To Sundries (as per S.R. Book) | 6.75 |

Output IGST Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2017 | 2017 | ||||||

| Dec. 31 | To Sundries (as per S.R. Book) | 23.75 |

Journal Proper

The Journal Proper, also known as the General Journal, is the subsidiary book of original entry that records all transactions which, due to their nature, cannot be recorded in any of the other special purpose books (i.e., Cash Book, Purchases Book, Sales Book, Purchases Return Book, and Sales Return Book). It acts as a residual journal, capturing all non-repetitive, miscellaneous, and adjustment-related transactions, ensuring that every business transaction has a place in the books of original entry.

Types of Entries Recorded in the Journal Proper

The Journal Proper is versatile and crucial for maintaining accurate financial records. The most common types of entries recorded are detailed below:

-

Opening Entries: At the beginning of a new financial year, an opening entry is passed to bring the closing balances of assets and liabilities from the previous year's Balance Sheet into the new set of books. The entry is framed by debiting all asset accounts, crediting all liability accounts, and crediting the Capital Account with the balancing figure (Assets - Liabilities).

Example Entry:

Date Particulars L.F. Debit Amount (₹) Credit Amount (₹) 2023 Apr. 01 Machinery A/cDr. 1,50,000 Debtors A/cDr. 50,000 To Creditors A/c 40,000 To Capital A/c (Balancing Figure) 1,60,000 (Being opening balances of assets, liabilities and capital brought forward) -

Closing Entries: At the end of the financial year, all nominal accounts (revenues and expenses) must be closed. Their balances are transferred to the Trading and Profit & Loss Account to ascertain the gross profit/loss and net profit/loss. These transfer entries are passed in the Journal Proper.

Example Entry:

Date Particulars L.F. Debit Amount (₹) Credit Amount (₹) 2024 Mar. 31 Trading A/cDr. 3,25,000 To Purchases A/c 3,00,000 To Wages A/c 25,000 (Being direct expenses transferred to Trading Account at year-end) -

Adjustment Entries: To ensure that the financial statements present a true and fair view and adhere to the accrual basis of accounting, certain adjustments are needed at the year-end. These entries, such as for outstanding expenses, prepaid expenses, accrued income, unearned income, depreciation on assets, and interest on capital, are all recorded in the Journal Proper.

Example Entry (for Depreciation):

Date Particulars L.F. Debit Amount (₹) Credit Amount (₹) 2024 Mar. 31 Depreciation A/cDr. 15,000 To Machinery A/c 15,000 (Being depreciation charged on machinery for the year) -

Rectification Entries: These are entries passed to correct errors that may have been discovered in the books of accounts after the initial recording and posting. For instance, if a purchase was wrongly debited to the wrong account, a rectification entry in the Journal Proper would fix it.

Example Entry:

Date Particulars L.F. Debit Amount (₹) Credit Amount (₹) 2024 Jan. 15 Repairs A/cDr. 5,000 To Purchases A/c 5,000 (Being rectification of error where repairs were wrongly debited to Purchases Account) -

Transfer Entries: An entry passed to transfer an amount from one account to another. The most common example is transferring the final balance of the Drawings Account to the Capital Account at the end of the year to reflect the reduction in the owner's equity.

Example Entry:

Date Particulars L.F. Debit Amount (₹) Credit Amount (₹) 2024 Mar. 31 Capital A/cDr. 50,000 To Drawings A/c 50,000 (Being drawings account balance transferred to Capital Account at year-end) -

Miscellaneous Entries: This is a broad category for unique transactions that don't fit into any other specialised journal. This includes:

- Credit purchase or sale of assets (e.g., machinery, furniture).

- Goods transactions not for sale:

- Goods withdrawn by the owner for personal use (Drawings of goods).

- Goods distributed as free samples for sales promotion (Advertisement expense).

- Goods given away as charity or donation.

- Loss of Goods: Recording the value of goods lost due to fire, theft, or damage, and any related insurance claims.

- Bills of Exchange Transactions: Entries for the endorsement and dishonour of bills of exchange.